Support and Resistance Levels in Forex Trading

By efx_admin

20 January 2026

Support and resistance levels in forex trading define price zones where buying or selling pressure repeatedly influences market direction. These levels help traders understand market structure, identify high-probability trade areas, and manage risk with precision. At EoneFX, we use support and resistance analysis as a core part of disciplined, rule-based trading decisions.

What are the support and resistance levels in forex trading?

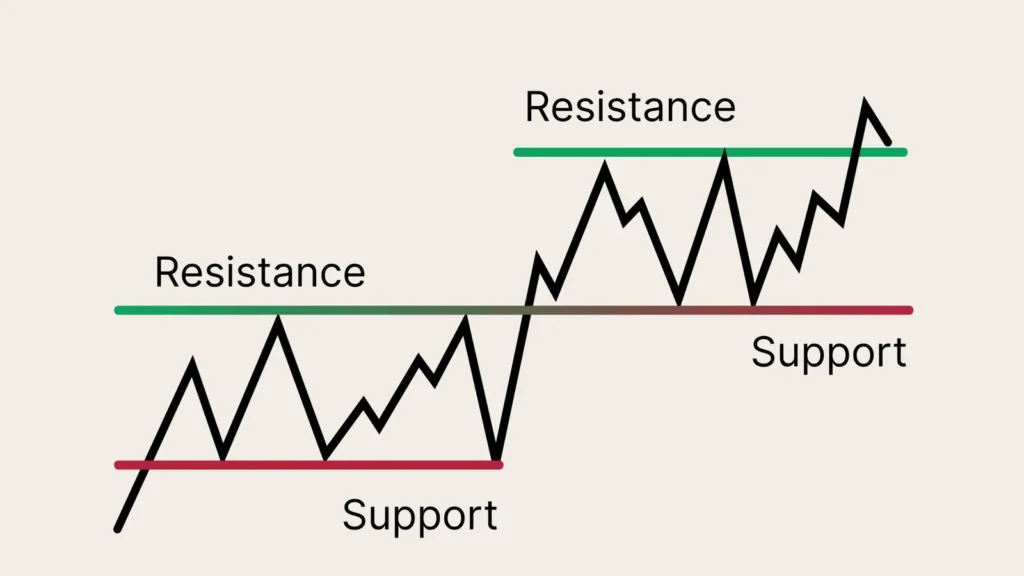

Support and resistance levels are price areas where the market historically pauses, reverses, or consolidates due to concentrated buying or selling activity.

Support represents a price level where demand tends to prevent further decline. Resistance represents a price level where supply tends to cap further upside.

Support and resistance levels reflect collective trader behavior, institutional positioning, and liquidity concentration. These levels remain relevant across all timeframes, from intraday scalping to long-term position trading.

What is support and resistance in forex markets?

Support and resistance in forex markets are structural reference points formed by repeated market reactions.

Support forms when buyers consistently enter the market at a specific price zone. Resistance forms when sellers repeatedly defend a specific price zone.

Forex support and resistance levels are not exact lines; they are price zones. Market volatility, liquidity conditions, and session overlaps influence how precisely price respects these areas.

How to identify and trade trendlines using support and resistance

Trendlines represent dynamic support and resistance levels that evolve with price direction.

List definition: A trendline is a diagonal price boundary connecting higher lows in an uptrend or lower highs in a downtrend.

Key identification rules:

- Uptrend support: Connect at least two higher lows without price closing decisively below the line.

- Downtrend resistance: Connect at least two lower highs without price closing decisively above the line.

- Validation: The more price reactions, the stronger the trendline.

Trading application:

Trendline confluence with horizontal support or resistance increases trade probability. Entries near validated trendlines allow tighter stop placement and clearer invalidation levels.

How to use round numbers and moving averages as support and resistance

Round numbers and moving averages act as psychological and technical support and resistance levels.

Unordered list definition: These tools highlight areas where price often reacts due to trader expectations and algorithmic strategies.

- Round numbers: Levels such as 1.1000 or 1.2000 attract liquidity and order clustering.

- Moving averages: Commonly used averages such as 50-period and 200-period serve as dynamic support or resistance.

- Institutional relevance: Large market participants monitor these levels for execution and risk management.

Best practice:

Support and resistance strength increases when round numbers and moving averages align with historical price reactions.

How to trade using forex support and resistance levels

Forex support and resistance trading focuses on reaction, confirmation, and risk control rather than prediction.

Core trading approaches:

- Range trading: Buying near support and selling near resistance within sideways markets.

- Breakout trading: Entering trades after confirmed closes beyond resistance or support with volume expansion.

- Pullback trading: Entering in the direction of trend when price retests a broken level.

Risk management principle:

Every support or resistance trade requires predefined invalidation. Stop-loss placement below support or above resistance protects capital during false breakouts.

Support and resistance levels in forex trading strategies

Support and resistance levels serve as the foundation for professional forex trading strategies.

Strategic benefits include:

- Improved entry timing

- Clear stop-loss placement

- Logical profit target identification

- Reduced emotional decision-making

At EoneFX, structured execution relies on level-based confirmation rather than impulsive entries. This approach aligns technical clarity with disciplined trade management.

Why support and resistance matter for consistent forex trading

Support and resistance levels transform market noise into a structured opportunity.

Traders who respect these levels trade with market logic instead of market emotion.

Consistency improves when trades are planned around validated levels rather than random price movement. Support and resistance analysis remains effective across all market conditions because it reflects real order flow behavior.

Final thoughts

Support and resistance levels in forex trading provide clarity, structure, and repeatability. Mastering these levels strengthens decision-making and enhances long-term trading discipline.

Table of Contents

- What are the support and resistance levels in forex trading?

- What is support and resistance in forex markets?

- How to identify and trade trendlines using support and resistance

- How to use round numbers and moving averages as support and resistance

- How to trade using forex support and resistance levels

- Support and resistance levels in forex trading strategies

- Why support and resistance matter for consistent forex trading

- Final thoughts