USD/INR Trades with Caution on FIIs’ Return After US-India Trade Deal Confirmation

By efx_admin

04 February 2026

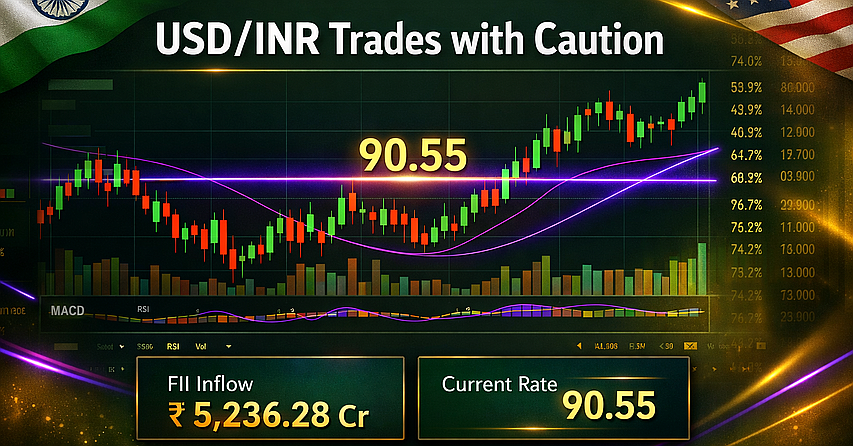

USD/INR demonstrates cautious trading patterns near 90.55 levels as Foreign Institutional Investors (FIIs) transition toward net buying positions following the confirmation of the US-India trade deal, marking a significant shift in forex trading news dynamics for Indian currency markets and creating new opportunities for forex education in India participants seeking to understand market movements through online forex education in India platforms and forex broker services.

Understanding the Current USD/INR Market Dynamics

Trade Deal Impact on Forex Trading

President Donald Trump’s announcement reducing tariffs on Indian goods from 50% to 18% represents a fundamental catalyst transforming the USD/INR pair’s trajectory and reshaping forex trading strategies across Indian markets, particularly for traders accessing online forex education in India resources through established forex broker platforms that provide comprehensive market analysis and real-time data for informed decision-making processes.

The tariff reduction framework established through bilateral negotiations between US and Indian leadership removes the additional 25% duty previously imposed as a response to India’s Russian oil procurement activities and creates favorable conditions for textile, machinery, and raw material exports from India to US markets, thereby improving the balance of trade fundamentals underlying the forex trading news landscape that professional traders monitor through specialized forex broker terminals.

FII Investment Patterns Reshaping Currency Markets

Foreign Institutional Investors purchased stocks worth Rs. 5,236.28 crore on the trading session following the trade deal announcement, representing the highest single-day inflow of overseas funds since October 28, 2025, according to Economic Times reporting, and demonstrating renewed confidence in Indian equity markets that directly influences USD/INR exchange rate movements studied extensively in forex education in India curricula and analyzed by forex trading professionals utilizing advanced forex broker research tools.

The net buyer position adopted by FIIs marks a reversal from the previous trend of sustained foreign outflows exceeding $22.9 billion from Indian equities throughout 2025 and signals improved sentiment toward Indian assets that creates downward pressure on the USD/INR pair as dollar demand moderates relative to rupee requirements for equity market participation facilitated through online forex education in India platforms teaching currency correlation dynamics.

Technical Analysis Framework for USD/INR Positioning

Current Price Action and Support Levels

USD/INR trades marginally lower around 90.55 as the pair maintains positions below the 20-day Exponential Moving Average (EMA) at 91.0466, which demonstrates a downward slope that caps rebound attempts and confirms near-term bearish momentum alignment studied in forex education in India programs focusing on technical analysis methodologies applicable to currency pair trading through regulated forex broker accounts.

The 14-day Relative Strength Index (RSI) registers at 44.82 within neutral territory yet positioned beneath the midline at 50.00, confirming waning upside momentum that forex trading professionals monitor as a key indicator of potential trend continuation or reversal scenarios requiring adjustment of position sizes and risk management parameters taught through comprehensive online forex education in India courses offered by reputable forex broker educational divisions.

Key Technical Levels for Forex Trading Strategies

Primary support exists at 90.00 levels with secondary support zones identified at 89.80 and 89.50 respectively, while resistance manifests at 91.00 marking the 20-day EMA confluence zone that forex education in India technical analysts emphasize as critical decision points for breakout or breakdown scenarios requiring vigilant monitoring through professional forex broker trading platforms equipped with real-time charting capabilities.

The declining 20-day EMA pattern keeps the near-term trend tilted toward lower price levels and suggests that successful reclamation of positions above this moving average would temper bearish pressure while potentially paving pathways toward stabilization phases that forex trading strategists identify as optimal entry points for counter-trend positions analyzed through advanced forex education in India technical frameworks.

Reserve Bank of India Monetary Policy Expectations

RBI Rate Decision Outlook

Market participants anticipate the Reserve Bank of India maintaining the Repo Rate at 5.25% during the monetary policy announcement scheduled for Friday, February 6, 2026, reflecting the central bank’s balanced approach toward supporting credit growth while managing inflationary pressures that fundamentally impact USD/INR valuations studied in forex education in India macroeconomic analysis modules and monitored closely by institutional forex trading desks operating through major forex broker networks.

The December 2025 policy meeting witnessed a 25 basis point reduction from 5.50% to 5.25% accompanied by INR 1.4 trillion liquidity injection through bond purchases and forex swaps, demonstrating the RBI’s accommodative stance favoring economic expansion over aggressive currency support that creates specific trading opportunities for forex trading professionals educated through comprehensive online forex education in India programs focusing on central bank policy interpretation.

Inflation and Economic Growth Considerations

Consumer price inflation measures approximately 0.25% while GDP expansion maintains robust 8.2% annual growth rates, creating a macroeconomic environment where the RBI prioritizes supporting economic activity over implementing aggressive monetary tightening measures that would strengthen the rupee against the US Dollar and alter fundamental valuation frameworks analyzed in advanced forex education in India curriculum modules covering macroeconomic policy impacts on currency markets.

Experts from HSBC and Nomura forecast one additional 25 basis point rate reduction during the first quarter of 2026 to sustain credit growth momentum, though hawkish Federal Reserve positioning may limit the extent of RBI easing cycles and create cross-border interest rate differential dynamics that sophisticated forex trading professionals exploit through carry trade strategies taught in specialized online forex education in India advanced strategy courses.

US Economic Data and Federal Reserve Positioning

Key US Economic Indicators

US ADP Employment Change data for January expects 48,000 new private sector jobs compared to 41,000 additions in December, representing modest improvement in labor market conditions that Federal Reserve officials monitor carefully when formulating monetary policy decisions impacting US Dollar strength across global forex trading markets and influencing USD/INR exchange rate trajectories analyzed by forex education in India fundamental analysis specialists.

The ISM Services Purchasing Managers’ Index (PMI) forecast anticipates 53.5 reading down from December’s 54.0 level, indicating continued expansion in the service sector at a moderating pace that suggests economic soft landing scenarios rather than recession risks and supports Federal Reserve arguments for maintaining current interest rate levels without immediate adjustment pressures that forex trading strategists incorporate into medium-term USD/INR forecasting models.

Federal Reserve Policy Trajectory

Market expectations reflect 100% probability that the Federal Reserve maintains interest rates within the 3.50%-3.75% range during the March 2026 policy meeting, according to CME FedWatch tool calculations, creating stable interest rate differential frameworks between US and Indian monetary policies that forex education in India programs emphasize as fundamental drivers of currency pair valuations requiring continuous monitoring through professional forex broker economic calendar tools.

The nomination of Kevin Warsh as Federal Reserve Chairman by President Trump introduces potential policy shift considerations, as Warsh’s previous work demonstrates a preference for firmer US Dollar positioning that could strengthen the greenback against emerging market currencies, including the Indian Rupee, and create trading opportunities for forex trading professionals monitoring leadership transition dynamics through specialized online forex education in India geopolitical analysis modules.

Forex Trading Strategies for the Current Market Environment

Risk Management Framework

Forex trading professionals operating in USD/INR markets implement strict stop-loss protocols below key support levels at 90.00 and 89.80 while maintaining profit targets aligned with resistance zones near 91.00 and 91.50, creating favorable risk-reward ratios that forex education in India risk management curricula emphasize as essential components of sustainable trading performance across various market conditions and volatility regimes.

Position sizing calculations incorporate Average True Range (ATR) measurements to determine appropriate trade volumes relative to account equity and individual risk tolerance parameters, representing best practices taught through comprehensive online forex education in India courses focusing on capital preservation techniques and probability-based decision-making frameworks implemented through advanced forex broker trading platforms.

Breakout and Breakdown Scenarios

Sustained price action above 91.00 levels signals potential trend reversal that could target the 91.50-92.00 zone where previous resistance concentrations exist and where forex trading professionals place conditional buy orders with predetermined risk parameters aligned with technical breakout confirmation signals taught in forex education in India, price action analysis modules emphasizing pattern recognition and momentum validation techniques.

Conversely, decisive breaks below 90.00 support activate bearish continuation patterns targeting the 89.50 and potentially 89.00 psychological support levels where value-oriented buyers may emerge and where skilled forex trading practitioners position limit orders to capture potential reversal opportunities analyzed through multi-timeframe technical frameworks emphasized in advanced online forex education in India strategic positioning courses.

Impact of Agricultural and Dairy Sector Protections

Trade Deal Sector-Specific Provisions

Commerce Minister Piyush Goyal confirmed that agricultural and dairy sectors maintained protection from international exposure during trade deal negotiations, addressing market participant concerns about potential compromises on critical domestic industry segments and reinforcing government commitment to balanced trade agreements that support both export growth and domestic production capacity safeguarding as analyzed in forex education in India geopolitical risk assessment modules.

The non-compromise policy on sensitive sectors demonstrates Indian negotiators’ strategic approach to trade liberalization that prioritizes economic benefits while protecting vulnerable domestic industries from disruptive foreign competition, creating stable policy frameworks that forex trading professionals incorporate into long-term USD/INR valuation models developed through comprehensive online forex education in India fundamental analysis training programs.

Currency Pair Performance Comparison

USD/INR Relative Strength Analysis

The Indian Rupee demonstrates strongest performance against the Japanese Yen among major currency pairs tracked in cross-currency performance matrices, while showing moderate strength against the US Dollar, Euro, and British Pound, reflecting differentiated risk sentiment flows and interest rate differential dynamics across global forex trading markets analyzed through comparative valuation frameworks taught in forex education in India cross-pair correlation modules.

The US Dollar Index (DXY) trades relatively flat around 97.45 approaching weekly highs near 97.73 posted earlier in the trading week, indicating broad greenback stability that creates specific USD/INR trading dynamics where India-specific factors exert greater influence on exchange rate movements than general US Dollar strength trends analyzed by forex trading professionals utilizing multi-factor analytical models.

Corporate Dollar Demand Patterns

Import Hedging Activity

Corporate entities stepped up dollar purchases to hedge import costs and overseas payment obligations, creating natural demand for US Dollars that limits the extent of rupee appreciation even as FII equity inflows generate offsetting dollar supply through investment repatriation and currency conversion processes studied in forex education in India corporate treasury management modules focusing on natural hedging techniques and derivative instrument applications.

The Reserve Bank of India’s $10 billion three-year dollar-rupee swap operation influences liquidity conditions and trading activity patterns in the forex trading markets, representing central bank intervention mechanisms that sophisticated market participants monitor through professional forex broker platforms providing real-time central bank operation tracking and analysis tools integrated with comprehensive online forex education in India resources.

Medium-Term Outlook and Forecast Scenarios

2026 Exchange Rate Projections

Analyst forecasts anticipate USD/INR trading within 87.00 to 95.90 range throughout 2026 depending on economic performance variables, global risk sentiment evolution, and policy trajectory developments across both US and Indian monetary authorities, creating diverse scenario planning requirements for forex trading professionals managing medium-term currency exposure through strategic positioning taught in advanced online forex education in India forecasting methodology courses.

CareEdge Ratings expects USD/INR at 87.00 by fiscal year-end 2026, reflecting anticipated Federal Reserve rate reductions and positive US-India trade developments against the backdrop of historically undervalued rupee positioning that presents potential appreciation scenarios contingent on sustained FII inflows and economic growth maintenance analyzed through multi-variable econometric models emphasized in forex education in India quantitative analysis programs.

Technical Pattern Development

Daily chart patterns show significant upward movement with price action breaking to fresh all-time highs above 92.00 during late January 2026 before retracing toward current 90.55 levels, demonstrating the volatile nature of trending market conditions that forex trading professionals navigate through disciplined technical analysis frameworks and risk management protocols developed through comprehensive forex broker educational resources and online forex education in India technical trading courses.

The 14-day RSI previously reached 74.00 levels signaling overbought conditions that precipitated the recent pullback phase from record highs, illustrating the importance of momentum indicator monitoring and divergence analysis techniques taught in forex education in India oscillator-based trading strategy modules emphasizing systematic entry and exit point identification across different market cycle phases.

Conclusion

USD/INR navigates cautious trading patterns in the immediate aftermath of transformative US-India trade deal confirmation as Foreign Institutional Investors demonstrate renewed commitment to Indian equity markets through substantial net buying activity that creates fundamental support for the rupee against sustained US Dollar demand from corporate importers and creates complex trading dynamics requiring sophisticated analysis through professional forex education in India programs and advanced forex trading strategies implemented via regulated forex broker platforms offering comprehensive market access and educational resources for online forex education in India participants seeking to develop expertise in currency market participation and risk management excellence.

Table of Contents

- Understanding the Current USD/INR Market Dynamics

- Technical Analysis Framework for USD/INR Positioning

- Reserve Bank of India Monetary Policy Expectations

- US Economic Data and Federal Reserve Positioning

- Forex Trading Strategies for the Current Market Environment

- Impact of Agricultural and Dairy Sector Protections

- Currency Pair Performance Comparison

- Corporate Dollar Demand Patterns

- Medium-Term Outlook and Forecast Scenarios

- Conclusion